Decoding RBI's Repo Rate Hikes: Navigating Global Challenges and Inflationary Pressures

In the midst of a challenging global landscape marked by geopolitical tensions and economic uncertainties, the Reserve Bank of India (RBI) has taken a decisive stance on interest rates. Governor Shaktikanta Das recently highlighted in an interview that interest rates are set to remain elevated, citing the intricate nature of monetary policies and the ongoing geopolitical crisis. This move aligns with a broader trend, as major central banks globally have raised their key policy rates to combat surging inflation.

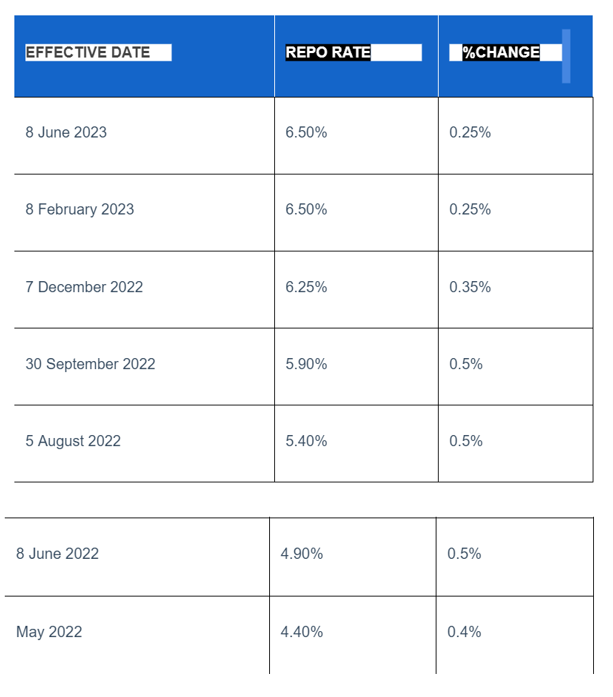

The change in repo rate in India be summed up as follows:

Repo Rate Changes: A Response to Global and Domestic Dynamics:

Examining the recent history of repo rate changes in India, it becomes evident that the RBI has been proactive in responding to economic challenges. Since May of the previous year, the central bank has raised the short-term lending rate by a substantial 250 basis points, reflecting the gravity of the situation. The cascading effects of these adjustments have been felt by consumers, with a significant reduction in purchasing power since the peak observed in July.

The repo rate, a crucial tool wielded by the central bank, plays a pivotal role in controlling the flow of money in the market. In times of inflation, the RBI strategically increases the repo rate. This, in turn, compels banks borrowing from the central bank to pay higher interest, discouraging excessive borrowing and reducing the overall money supply in the market—a crucial step in mitigating inflation. Conversely, during a recession, the repo rates are decreased to stimulate economic activity.

To stabilize the multifaceted challenges of inflation, currency stability, and global economic conditions, the RBI strategically employs the repo rate. Recent shifts have seen real interest rates turning positive after several years, aligning with the central bank's objective of maintaining price stability—a mandate enshrined in the law. Prolonged negative real interest rates, where inflation outpaces nominal interest rates, are recognized as potential instigators of financial system instability.

Global Dynamics and the Road Ahead:

The evolving global financial conditions, coupled with the potential for further volatility, present a complex environment for the RBI. While domestic inflation is projected to align with policy targets by the end of FY24, challenges persist. Elevated rates in developed markets and record-low interest differentials pose headwinds for the RBI. The central bank remains cognizant of the role of relative forex adjustments as shock absorbers, even as the speed and duration of such adjustments present uncertainties.

In conclusion, the RBI's repo rate adjustments underscore a strategic and nuanced approach to the current economic challenges. Balancing the need for stability with the imperative to address inflationary pressures, the central bank employs a versatile toolkit. By favoring orderly forex adjustments over conventional rate hikes, the RBI signals a commitment to adaptability and resilience. As global financial conditions continue to evolve, the central bank's proactive stance positions it to navigate the unpredictable path ahead with foresight and determination.